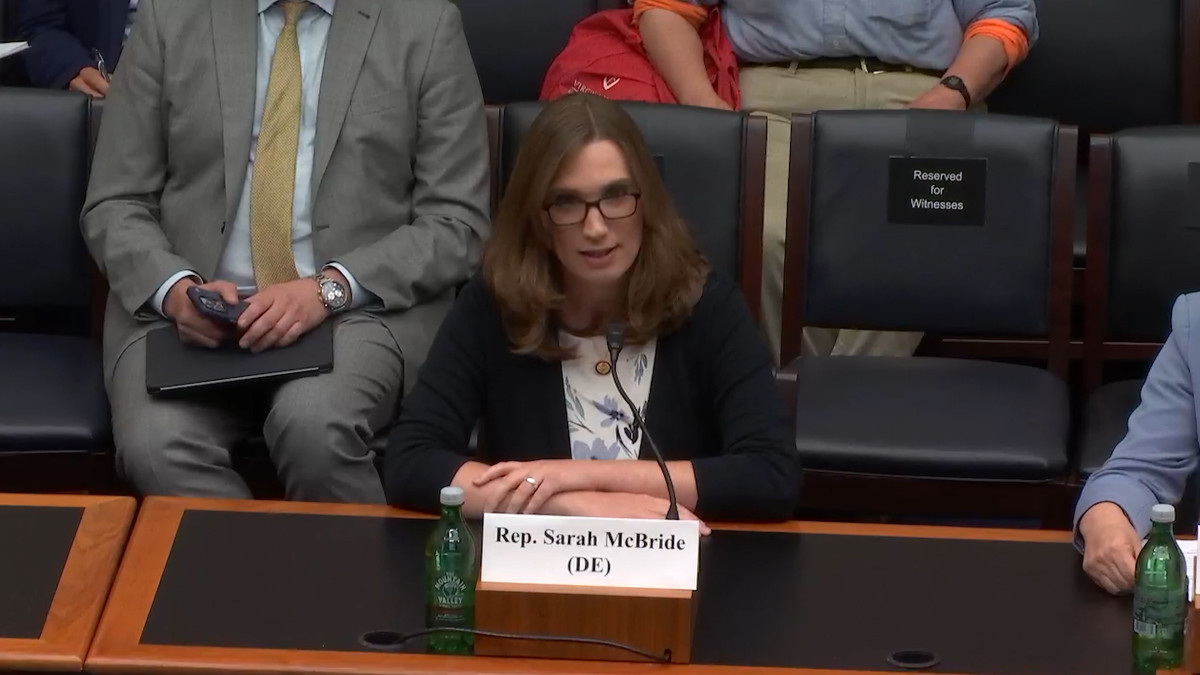

Rep. McBride Testifies Before House Financial Services Committee on Bipartisan Bill to Crack Down on Credit Repair Scams

Washington, D.C. — Today, Delaware’s Congresswoman testified before the U.S. House Committee on Financial Services in support of her bipartisan bill, Ending Scam Credit Repair Act (ESCRA). This bill targets deceptive credit repair organizations (CROs) that mislead consumers with high upfront fees and false promises of credit score improvements. ESCRA would strengthen consumer protections, increase transparency, and hold bad actors accountable.

Rep. McBride’s full testimony can be accessed here and the transcript is below:

“Thank you, Chair Hill and Ranking Member Waters, for having me today.

“I am here to discuss my bipartisan bill, H.R. 306, the Ending Scam Credit Repair Act, also known as ESCRA. I’d like to thank my colleague, Representative Young Kim, for serving as the Republican co-lead on this legislation.

“We’ve all seen the commercials for so-called credit repair organizations, also known as CROs—shiny promises and toll-free numbers offering miraculous credit score boosts. But what we don’t see behind those advertisements is the deception, the abuse, and the heartbreak. Behind the curtain are CROs exploiting legal loopholes, charging high upfront fees, taking advantage of our confused constituents, and overwhelming financial institutions with manipulative tactics—leaving vulnerable Americans worse off than before.

“Our bill cracks down on these abusive and fraudulent practices by CROs. It prohibits them from charging upfront fees until at least six months after they’ve provided proof of real credit score improvement. While this protection is already the law, CROs exploit a loophole to rip consumers off anyway. As long as they don’t use certain telemarketing sales practices, they’re able to evade this consumer protection. Our bill rightfully closes that loophole.

“ESCRA also prohibits CROs from jamming financial institutions with duplicative requests, which have prevented those institutions from addressing legitimate credit report issues. Additionally, ESCRA strengthens state oversight, raises penalties for bad actors, and ensures that every consumer knows their rights: that they can do all of this, on their own, for free.

“Our bill doesn’t punish legitimate services. It protects the ethical actors who are trying to do the right thing.

“Both the financial services industry and consumer advocates—groups that rarely align—support ESCRA. This legislation exemplifies how Congress is supposed to work: bringing people together to improve life for our constituents. Preventing scams is not a partisan issue.

“In Delaware, I’ve spoken with hardworking families who, in moments of financial stress, turned to these companies believing help was on the way. Instead, they were met with high costs, false hope, and ultimately, more debt and confusion. That’s not just immoral—it should be illegal.

“Thank you, and I urge the Committee to consider this much-needed, bipartisan legislation.

“I yield back the remainder of my time.”

Rep. McBride introduced ESCRA her first week in Congress, becoming the first Democratic freshman to introduce a piece of legislation in the 119th Congress.

Last year, the Consumer Financial Protection Bureau (CFPB) took action against a conglomerate of the nation’s largest credit repair organizations for illegally collecting fees. Following the lawsuit, the CFPB is now distributing $2.7 billion to over four million consumers nationwide, including more than $8 million to Delawareans. To prevent such abuses in the future, ESCRA prevents credit repair organizations from charging illegal upfront fees.

The bipartisan Ending Scam Credit Repair Act protects consumers by prohibiting CROs from charging consumers until six months after they’ve provided proof that their credit score has improved while also increasing civil penalties for violations. The bill prohibits CROs from “jamming” financial institutions with duplicative requests, which has prevented consumer reporting agencies and data furnishers from addressing legitimate credit report issues.

The bill is supported by the Delaware Attorney General, Community Legal Aid Society, Inc, Delaware Community Reinvestment Action Council, American Financial Services Association, National Consumer Law Center, AARP, Consumer Action, American Bankers Association, Consumer Bankers Association, National Association of Consumer Advocates, American Fintech Council and the National Association of Consumer Bankruptcy Attorneys.

###